Content

- Matrix Pricing – Debt Ratings

- What is the formula for calculating the cost of debt?

- Difficulties With Using WACC

- Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

- Debt cost valuation

- Additional Resources

- Cost of Equity

- Best Small Business Credit Cards for Travel

They also use metrics, such as credit rating, to determine an annual interest rate. Loan providers want to ensure that borrowers are able to pay them back. To lower your interest rates, and ultimately your cost of debt, work on improving your credit score. The weighted average cost of capital is a core metric used by investment bankers, private equity analysts, investors, and corporate finance team members like accountants. For example, in an investment bank’s mergers & acquisitions (M&A) side, analysts use WACC as part of business valuation practices, such as a discounted cash flow (DCF) analysis. Put simply, the cost of capital is how much a company needs to pay to finance operation.

Equity financing tends to be more expensive because of the higher returns yielded from the stock market. Okay, now I will put together a chart pulling together the cost of debt for the FAANG stocks using the TTM (trailing twelve months) numbers for the “most” current after-tax cost of debt we can calculate. Next, we will locate Microsoft’s total debt from the balance sheet below. A company’s income tax will be lower because of the deduction of the interest component from taxable income. That risk of default drives higher interest rates on their bond offerings to encourage investment.

Matrix Pricing – Debt Ratings

We discuss how to calculate complex cost of debt below, which includes the impact of taxes. In exchange for investing, shareholders get a percentage of ownership in the company, plus returns. To calculate the after-tax cost of debt, we multiply the cost of debt by the difference of 1 minus the effective tax rate. We use the company’s state and federal rates combined to determine the effective tax rate, not the marginal tax rate, which includes many tax offsets like foreign tax rate deductions. Part of determining the future value of those cash flows is estimating a discount rate or hurdle rate for that investment.

How do you calculate cost of debt in WACC?

Notice in the Weighted Average Cost of Capital (WACC) formula above that the cost of debt is adjusted lower to reflect the company's tax rate. For example, a company with a 10% cost of debt and a 25% tax rate has a cost of debt of 10% x (1-0.25) = 7.5% after the tax adjustment.

When comparing, the capital structure of the company should be in line with its peers. The other approach is to look at the credit rating of the firm found from credit rating agencies such as S&P, Moody’s, and Fitch. A yield spread over US treasuries can be determined based on that given rating. That yield spread can then be added to the risk-free rate to find the cost of debt of the company. This approach is particularly useful for private companies that don’t have a directly observable cost of debt in the market.

What is the formula for calculating the cost of debt?

The “effective annual yield” (EAY) could also be used (and could be argued to be more accurate), but the difference tends to be marginal and is very unlikely to have a material impact on the analysis. On the Bloomberg terminal, the quoted yield refers to a variation of yield-to-maturity (YTM) called the “bond equivalent yield” (or BEY). If the company were to attempt to raise debt in the credit markets right now, the pricing on the debt would most likely differ. Don’t waste hours of work finding and applying for loans you have no chance of getting — get matched based on your business & credit profile today. In fact, companies and individuals may use debt to make large purchases or investments for further growth. To find your total interest, multiply each loan by its interest rate, then add those numbers together.

Based on the loan amount and interest rate, interest expense will be $16,000, and the tax rate is 30%. A free Google Sheets DCF Model Template to calculate the free cash flows and present values and determine the market value of an investment and its ROI. The reason why the after-tax cost of debt is a metric of interest is the fact that interest expenses are tax deductible.

Difficulties With Using WACC

The effective interest rate is your weighted average interest rate, as we calculated above. Several factors can increase the cost of debt, depending on the level of risk to the lender. These include a longer payback period, since the longer a loan is outstanding, the greater the effects of the time value of money and opportunity costs. The riskier the borrower is, the greater the cost of debt since there is a higher chance that the debt will default and the lender will not be repaid in full or in part. Backing a loan with collateral lowers the cost of debt, while unsecured debts will have higher costs.

To entice investors, bond offerings include interest payments, coupons, or, if it makes more sense, dividends. These payments encourage investors to take the risk of the investment. Cost of capital enables business leaders to justify and garner support for proposed ideas, decisions, and strategies. Stakeholders only back ideas that add value to their companies, so it’s essential to articulate how yours can help achieve that end.

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Cost of debt is repaid monthly through interest payments, while cost of equity is repaid through returns, such as dividends. In other words, cost of debt is the total cost of the cost of debt formula interest you pay on all your loans. Because of these risks and rewards for both equity and debt, companies tend to balance their use of financing to achieve the optimal balance.

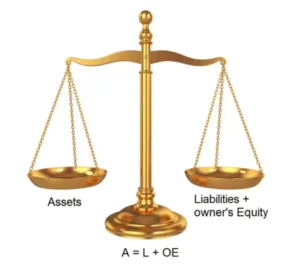

In the example, the net cost of debt to the organization declines, because the 10% interest paid to the lender reduces the taxable income reported by the business. In debt financing, one business borrows money and pays interest to the lender for doing so. The formula for calculating the cost of debt is Coupon Rate on Bonds x (1 – tax rate). Debt financing tends to be the preferred vehicle for raising capital for many businesses, but other ways to raise money exist, such as equity financing.

You can schedule updates and automate processes to save time and minimize errors, as well as automatically share reports with interested parties. In an empty cell, type in the formula for cost of debt or before-tax cost of debt. In the next section, you have examples of how to calculate the before-tax and after-tax cost of debt using spreadsheet software. Provided with these figures, we can calculate the interest expense by dividing the annual coupon rate by two (to convert to a semi-annual rate) and then multiplying by the face value of the bond. As a preface for our modeling exercise, we’ll be calculating the cost of debt in Excel using two distinct approaches, but with identical model assumptions. If you only want to know how much you’re paying in interest, use the simple formula.

The cost of debt involves a formula that factors the total expense a business incurs with debt. The difference between the two calculations is that interest expenses are tax-deductible. The income tax paid by a business will be lower because the interest component of debt will be deducted from taxable income, whereas the dividends received by equity holders are not tax-deductible. As with most calculations, the first step is to gather the required data.

What Is Cost of Debt?

If a company uses exclusively short-term for financing, a good idea is to use its credit rating to approximate the cost of long-term debt. Long-term rates are better at approximating interest rate costs over time because they match the long-term focus of calculating free cash flows and their present-day values. The higher credit ratings or cost of debt tend to follow companies with higher risk levels. A company’s capital structure is one part debt and another part equity. A company’s capital structure manages how a company finances its overall operations and growth through different sources.

In this way, by calculating the quotient between these variables, we can know the weighted cost of debt, also known as Kd (weighted). This cost depends mainly on several factors such as the value of the debt, taxes, applicable interest rate, etc. Β measures the volatility of an investment with respect to the whole market. As the total https://www.bookstime.com/ market is assumed to have a β equal to 1, a stock whose return varies less than the ones of the market have a beta lower than 1. On the contrary, a stock whose return varies more than the returns of the market has a beta larger than 1. Michelle Lambright Black is a nationally recognized credit expert with two decades of experience.

0 commentaires